Hotel Project Feasibility Consultants

Our work as hotel project feasibility consultants starts with market analysis and the feasibility of new development, the acquisition and disposition of properties, and a role as owner representative and asset manager on behalf of owner.

Of course, as the hotel industry manages through the difficult circumstances wrought by the Covid-19 pandemic, the focus of much of our consulting work has necessarily changed. Operating occupancies in the U.S. remain at or about 40% (less in many international regions) and travelers have changing preferences for their accomodations.

As a real estate investment asset class, branded hotels and resorts are now in a period of focused reexamination.

Many hotel branded products that have depended upon corporate meetings and travel, are currently obsolescent from an economic standpoint, while other lodging products are proving almost pandemic-proof. As one of the significant real estate investment asset classes, branded hotels and resorts are now in a period of focused reexamination.

Some examples of our recent work as hotel project feasibility consultants, include:

- Planning as part of collaborative design teams, to support client mixed-use redevelopment opportunities, particularly as part of solutions for failing shopping malls;

- Feasibility, business planning, and conceptual design for new glamping and eco-resort products, recreational vehicle (RV) parks and campgrounds, as well as major recreation adventure resorts;

- Assistance to local governments in restarting regional visitor destinations, as a means of boosting local economic development;

- More traditional consulting support, such as project feasibility studies for new development, and due diligence for client acquisitions – whether single properties or portfolios.

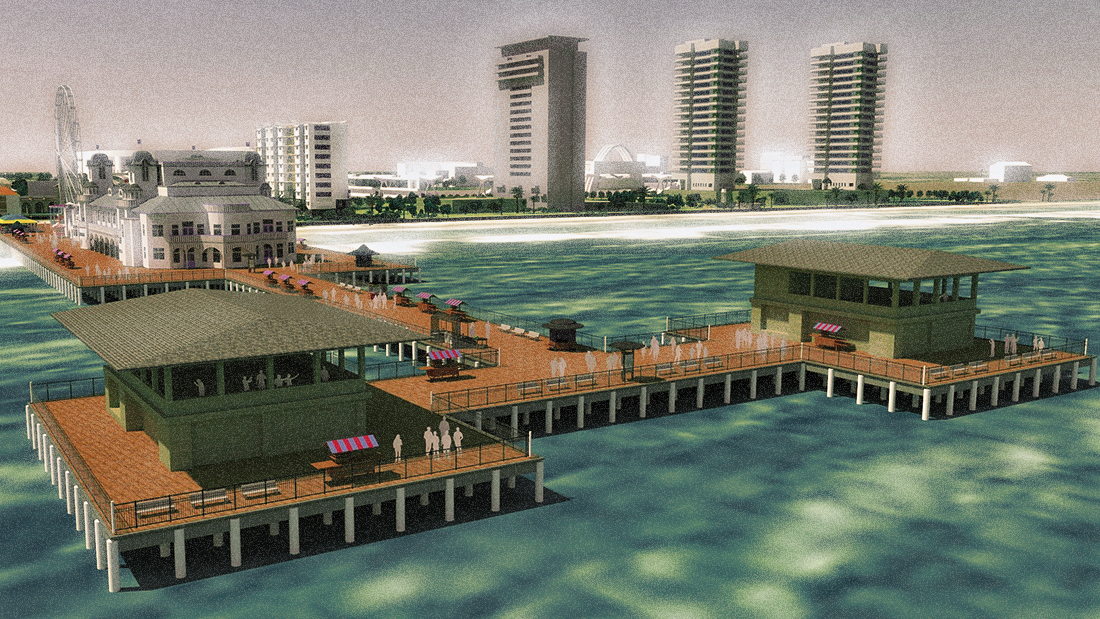

Our firm’s essential value to clients is our hands-on experience in designing, developing, and operating projects and businesses. StoneCreek Partners is led by co-founder Donald Bredberg and his substantial experience as an executive with The Irvine Company, NBCUniversal, and the Riyadh-based family office of Newfield Enterprises International.

Glamping and eco-resort accomodations are likely to do well in coming years, as travelers adapt to a world of social distancing and health concerns.

The firm was first established in 1984 in Los Angeles, and is now headquartered in Nevada. Our work as hotel project feasibility consultants got started shortly after the firm’s founding. In those early days, as part of managing a portfolio of luxury hotels for a Saudi family office, our firm’s co-founder Donald Bredberg was one of the initial founder members of the Hotel Asset Manager’s Association.

Additional information about our hotel and resort consulting practice, is available at the link below:

StoneCreek Partners – Hotel, Resort, and Accommodations Consulting Practice