The World’s Largest Mega Projects – the Latest

The world’s largest mega projects are tracked in our Global Top 100 index, including primarily private-sector and public-private real estate projects. The largest of these mega projects are typically mixed-use (or multi-use as the Urban Land Institute may suggest), involve regeneration (redevelopment) of existing properties, and cost in excess of USD $1 billion.

There is great variety in these megaprojects. In general, no two are alike since each is customized to its location, setting, and economic circumstances. Some such as the redevelopment of Philadelphia Energy Solutions’ refinery in Philadelphia include a large land area (here, 1,300 acres) and a vision of a huge build-out (15 million square feet). Other mega-projects are developed at much higher densities on smaller project sites. Sunnyside Yard Queen in New York is a proposed $14.5 billion development on 180 acres, that would include 12,000 house units.

During 2020, the Covid-19 pandemic has not obviated interest in these projects proceeding, and in fact, new projects have been announced.

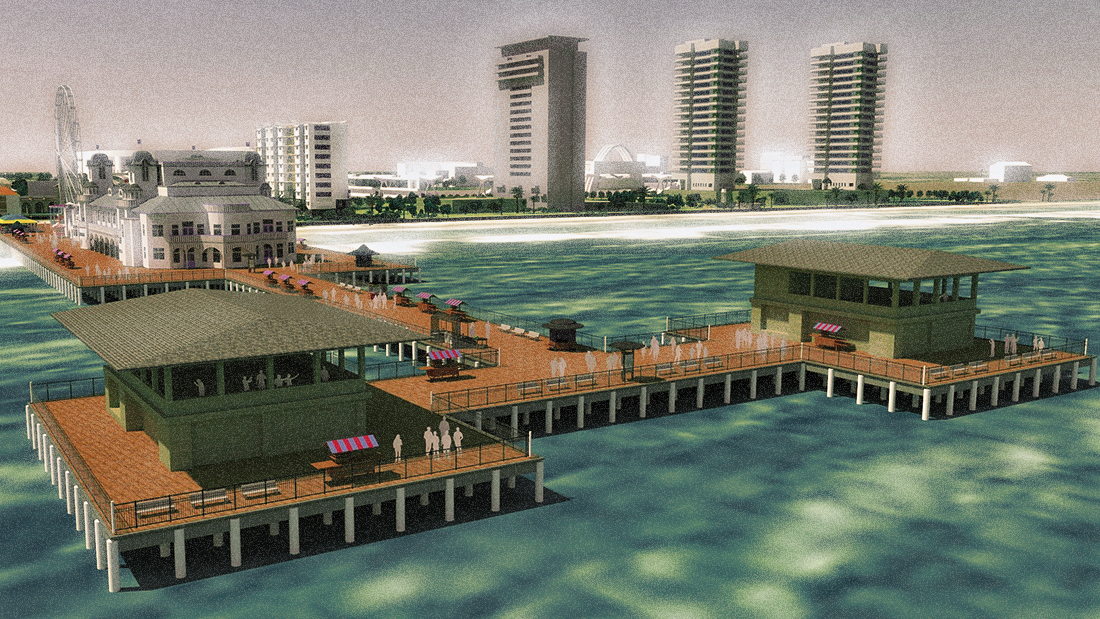

The Global Top 100 Mega Projects also include what are essentially, all-new cities. Eko Atlantic in Lagos (Nigeria) is situated on 2,471 acres of coastal landfill and is well into development. Egypt’s new capital city is under construction east of Cairo, and is a massive investment intended to fully replace Cairo in its central governance role.

The public sector is frequently a partner in these projects since the regional economic development impact can be enormous, net of public investment in infrastructure and other incentives.

During 2020, the Covid-19 pandemic has certainly impacted the planning and construction of new mega projects, but in general, has not obviated investor and governmental interest in these projects proceeding. In fact, new projects have been announced in the midst of the pandemic.

Defining a Mega-Project

Most definitions offered for mega projects define such projects as having a capital budget in excess of USD $1 billion. According to the Oxford Handbook of Megaproject Management, “Megaprojects are large-scale, complex ventures that typically cost $1 billion or more, take many years to develop and build, involve multiple public and private stakeholders, are transformational, and impact millions of people.”

For more Information

Our ongoing mega project research is available here > Global Top 100 Mega Projects – the Latest List